Contact Seller

Graham County Crop & Pastureland - December 3

Description

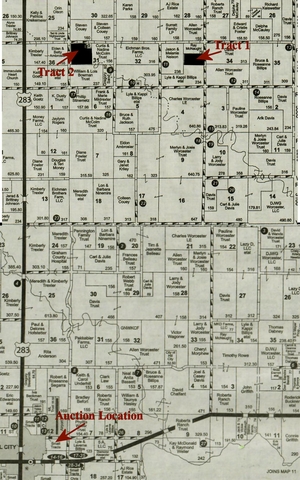

230 +/- ACRES of GRAHAM COUNTY KS. CROP & PASTURELAND SELLING IN 2 TRACTS

Selling for Phillip & Susan Stinemetz

Tuesday, December 3rd, 2024 - 10:00 A.M.

Auction Location: Cowboy Junction, Hill City Ks.

260th Ave at the South Edge of the Golf Course

Be Sure to Check Our Website for More Info. & Pictures

Come Early for Refreshments & to Register for Bid Number

Live Online Bidding Available at www.hamitauction.com

Land Locations: From Hwy. Jct. 24 & 283 in Hill City, Ks. – Tract 1- 8 Mi. North on Hwy 283 to Y Rd, 4 Mi. East to 310 Ave and ½ Mi. North to the Southeast Corner. Tract 2 - 8 Mi. North on Hwy 283 to Y Rd, 1 Mi. East to 280 Ave. and ½ Mi. North to the Southwest Corner.

WATCH FOR SIGNS!

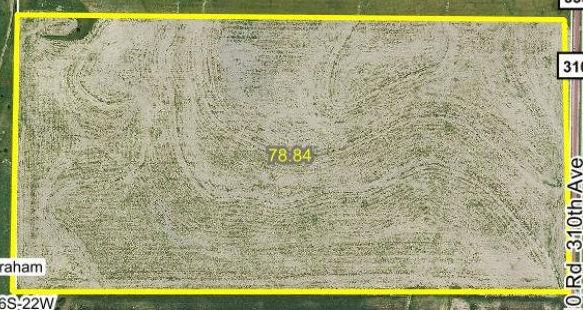

TRACT 1 - Legal Description: SURFACE ONLY in and to; The South Half Northeast Quarter (S/2NE/4) of Section Thirty-Three (33), Township Six (6) South, Range Twenty-two (22) West of the 6th P.M., Graham County, Ks.

General Description: This tract of land is all excellent cropland with the Holdrege Silt Loam being the primary soil type. This is great for abundant crop production.

FSA Information: This tract has a total of 78.91 total cropland with a wheat base of 31.60 acres with a 39 bu PLC yield, soybean base 15.8 acres with a 34 bu. PLC yield, corn base of 2.76 acres with a 71 bu PLC yield and a grain sorghum base 5.92 acres with a 49 PLC yield

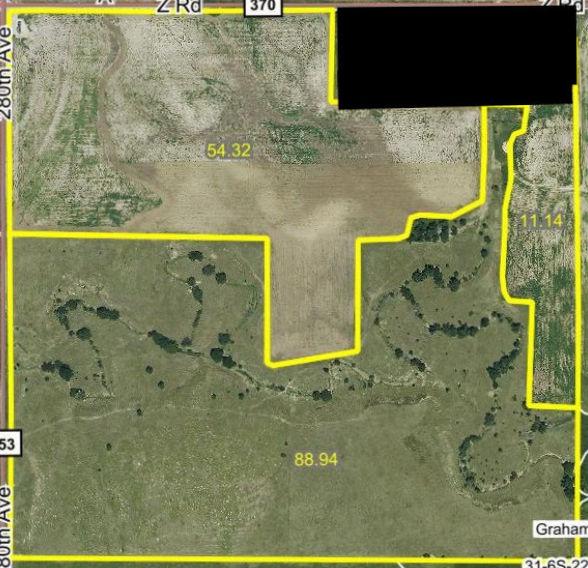

TRACT 2 – Legal Description: SURFACE ONLY in and to; The Northwest Quarter (NW/4) of Section Thirty-one (31), Township Six (6) South, Range Twenty-two (22) West of the 6th P.M., Graham County, Ks. Less an approximate 12-acre tract in the Northeast corner. Acreage subject to survey results.

FSA Information: This tract will have a total of approximately 150 total acres with 56 acres of cropland and the balance is pastureland. The wheat base is 26.21 acres with a 39 bu PLC yield, soybean base 13.1 acres with a 34 bu. PLC yield, corn base of 2.28 acres with a 71 bu PLC yield and a grain sorghum base 4.9 acres with a 49 PLC yield.

Taxes: Seller will pay all the 2024 and prior years taxes with the purchasers paying all the 2025 and subsequent year’s taxes. 2023 Taxes were: Tract 1-$909.13 and Tract 2 - $887.91

Closing & Possession: Closing will be scheduled for January 6, 2025, and possession will be granted immediate upon closing.

Title Insurance: Title insurance shall be used to prove clear & merchantable title with the Buyer & Seller sharing equally the owner’s policy expense and closing agents’ fee. The mortgage policy, if required, will be the expense of the buyer.

Terms: Ten Percent (10%) down day of sale balance due upon closing. This auction sale is not contingent upon the purchaser's ability to finance the purchase. Buyers must make finance arrangements, if needed, prior to the auction.

Announcements: Property information provided was obtained from sources deemed reliable, although the Auctioneer(s) or Seller(s) make no guarantees as to its accuracy. All prospective bidders are urged to fully inspect the property, its condition and to rely on their own conclusions. Any announcements made on auction day by the auctioneer will take precedence over any previous printed material or oral statements.